Out with the old, in with the new—VAT deregistration made easy for your business transition!

What is VAT Deregistration?

VAT Deregistration is the process of removing a business from the VAT system when it no longer meets the requirements for VAT registration. This typically happens when a business's taxable turnover falls below the VAT threshold or if the business ceases its taxable activities.

When Can a Business Apply for VAT Deregistration in the UAE?

A business can apply for VAT deregistration in the following situations:

Turnover Falls Below the Threshold:

If the business’s taxable turnover drops below AED 187,500 (the voluntary registration threshold), it may apply for deregistration.Cessation of Business Activities:

If the business ceases its taxable operations or is permanently closed, VAT deregistration is required.Exemption from VAT:

If the business no longer makes taxable supplies and is dealing only in exempt supplies, deregistration may be necessary.Voluntary Deregistration:

A business that has voluntarily registered for VAT may choose to deregister if its taxable supplies fall below the minimum threshold or under certain other circumstances.

How Smart Management Services Can Help

At Smart Management Services, we simplify the VAT deregistration process by offering:

- Eligibility Assessment: We evaluate whether your business qualifies for VAT deregistration.

- Documentation Assistance: Helping you gather and prepare the necessary documents for the application.

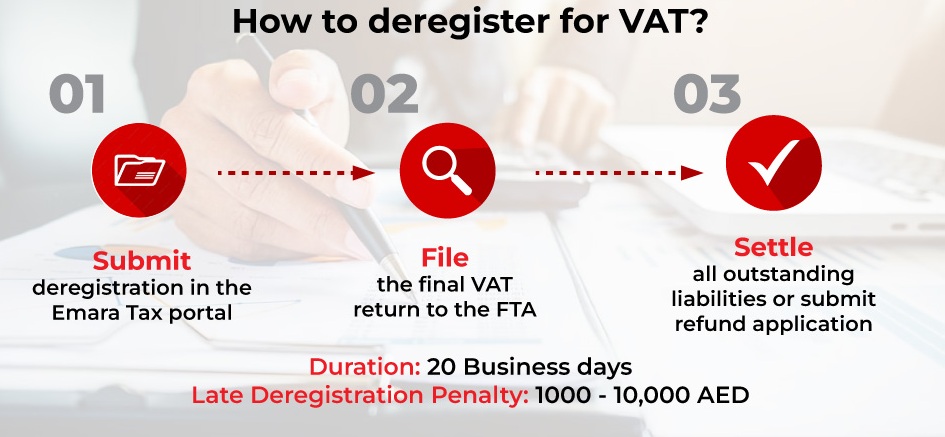

- Submission and Follow-Up: Managing the entire VAT deregistration process through the FTA portal.

- Compliance Advice: Providing ongoing support to ensure your business remains compliant with UAE tax regulations.

We ensure that your VAT obligations are seamlessly concluded, letting you focus on the next chapter of your business journey.

VAT

Get In Touch